(Bloomberg) — SoftBank Group Corp. swung to a quarterly profit, riding on gains from its bets on Nvidia Corp. and startups in a boon for founder Masayoshi Son’s bets on artificial intelligence technologies.

Most Read from Bloomberg

- All Hail the Humble Speed Hump

- Mayor Asked to Explain $1.4 Billion of Wasted Johannesburg Funds

- Three Deaths Reported as NYC Legionnaires’ Outbreak Spreads

- Major Istanbul Projects Are Stalling as City Leaders Sit in Jail

- PATH Train Service Resumes After Fire at Jersey City Station

A recovery at SoftBank’s signature Vision Fund and the sale of assets such as its T-Mobile US Inc. holdings are helping Son double down on bets geared to help him capitalize on booming investment in AI hardware. SoftBank, which had sold $4.8 billion worth of its stake in the US telecom company in June, on Thursday revealed the sale of another $3 billion of the US carrier’s stock.

The Tokyo-based company reported net income of ¥421.82 billion ($2.9 billion) in its fiscal first quarter, more than double the average of analyst estimates. The Vision Fund logged a ¥451.39 billion profit, helped by a recovery in tech valuations and gains on holdings such as Coupang Inc., Auto1 Group SE, Symbotic Inc. and Swiggy Ltd.

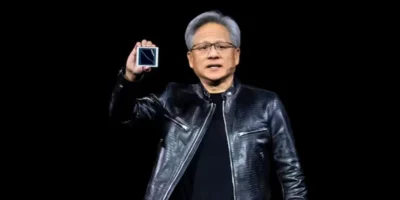

SoftBank’s earnings got an additional boost from paper gains on its recent purchases of stock in Nvidia and Taiwan Semiconductor Manufacturing Co. The Japanese company increased its stake in Nvidia to more than $3 billion as of end-March, helping the Japanese investor benefit from the AI accelerator maker’s 46% rally during the three months through June.

The 67-year-old SoftBank founder seeks to play a more central role in the spread of AI. Central to that push is its chip design unit Arm Holdings Plc and a $500 billion Stargate data center foray in the US with OpenAI, Oracle Corp. and Abu Dhabi’s tech investment fund MGX.

That Stargate push has been somewhat delayed, Chief Financial Officer Yoshimitsu Goto said, conceding for the first time that the $500 billion artificial intelligence tie-up with OpenAI was behind schedule. SoftBank will soon begin concrete talks on its first Stargate project, he said. The Tokyo-based investor was not involved in OpenAI’s data center plans in Norway, while OpenAI was leading the rollouts in the United Arab Emirates and Abilene, Texas, he said.

Some of the conversations behind Stargate have slowed due to market volatility, uncertainty around US trade policy and questions around the financial valuations of AI hardware, Bloomberg News reported in May.

“Things are taking more time than initially expected, but we’d like to speed things up from here,” Goto said during an earnings conference. “We are now focusing all our operations on AI and are working to expand on multiple fronts.”

As part of its multi-pronged push into AI, SoftBank is slated to invest as much as $30 billion in OpenAI, and it’s inked a $6.5 billion deal to buy chip designer Ampere Computing Holdings. Son is also courting TSMC and others about taking part in a $1 trillion AI manufacturing hub in Arizona.

SoftBank’s shares closed at a fresh record high ahead of the earnings release. US President Donald Trump’s threat to unleash 100% chip tariffs but exempt companies moving production to America is infusing optimism for the Stargate project.

“Our longer-term outlook for SoftBank Group is cautiously optimistic, with a consensus toward continued business expansion,” said Ashwin Binwani, founder of Alpha Binwani Capital.

But concern over whether SoftBank can manage multiple mass-scale funding needs as interest rates inch up is keeping its stock at a significant discount to the total net asset value of its holdings.

The company has been selling off assets ahead of such mega-projects and deals as the fair value of the Vision Fund portfolio rose $4.8 billion from the prior quarter. All told, the two Vision Funds sold off assets worth a total of $3.35 billion, including full exits from nine companies.

What Bloomberg Intelligence Says

SoftBank Group’s reported loan-to-value was 17% at June, but could weaken — with potential to breach its 25% target — as Arm shares are down by 16% since and it has committed to invest a further $10 billion or more in OpenAI. It has only invested about $650 million in Stargate and expects to complete the $6.5 billion acquisition of Ampere Computing by March, though this is pending regulatory approval. Share sales, most likely in telcos, could be a key tool to manage LTV.

-Sharon Chen, credit analyst

Click here for the research.

To be sure, SoftBank’s total OpenAI investment may be reduced if OpenAI does not restructure into a for-profit entity by the end of the year. And the Ampere deal remains subject to approval by US antitrust regulators and the Committee on Foreign Investment in the US, it said. That acquisition is facing a potentially lengthy probe, Bloomberg reported.

“Key points to consider in assessing SoftBank include whether investment in the Stargate Project involving AI infrastructure in the US will progress; whether additional investment in OpenAI amid a fluid management situation is tenable,” SMBC Nikko Securities analyst Satoru Kikuchi wrote in a note earlier this year.

–With assistance from Aya Wagatsuma and Vlad Savov.